Managing money on a tight income can feel like a juggling act. The 50/30/20 rule offers a simple, effective way to organize your finances without complex calculations. This budgeting method helps you allocate your income to needs, wants, and financial goals, making every rupee work harder. Whether you’re saving for a dream vacation or paying off debt, this rule provides clarity and balance. In this article, we’ll break down the 50/30/20 rule, explain how it works, and show you how to apply it to your life.

What Is the 50/30/20 Rule?

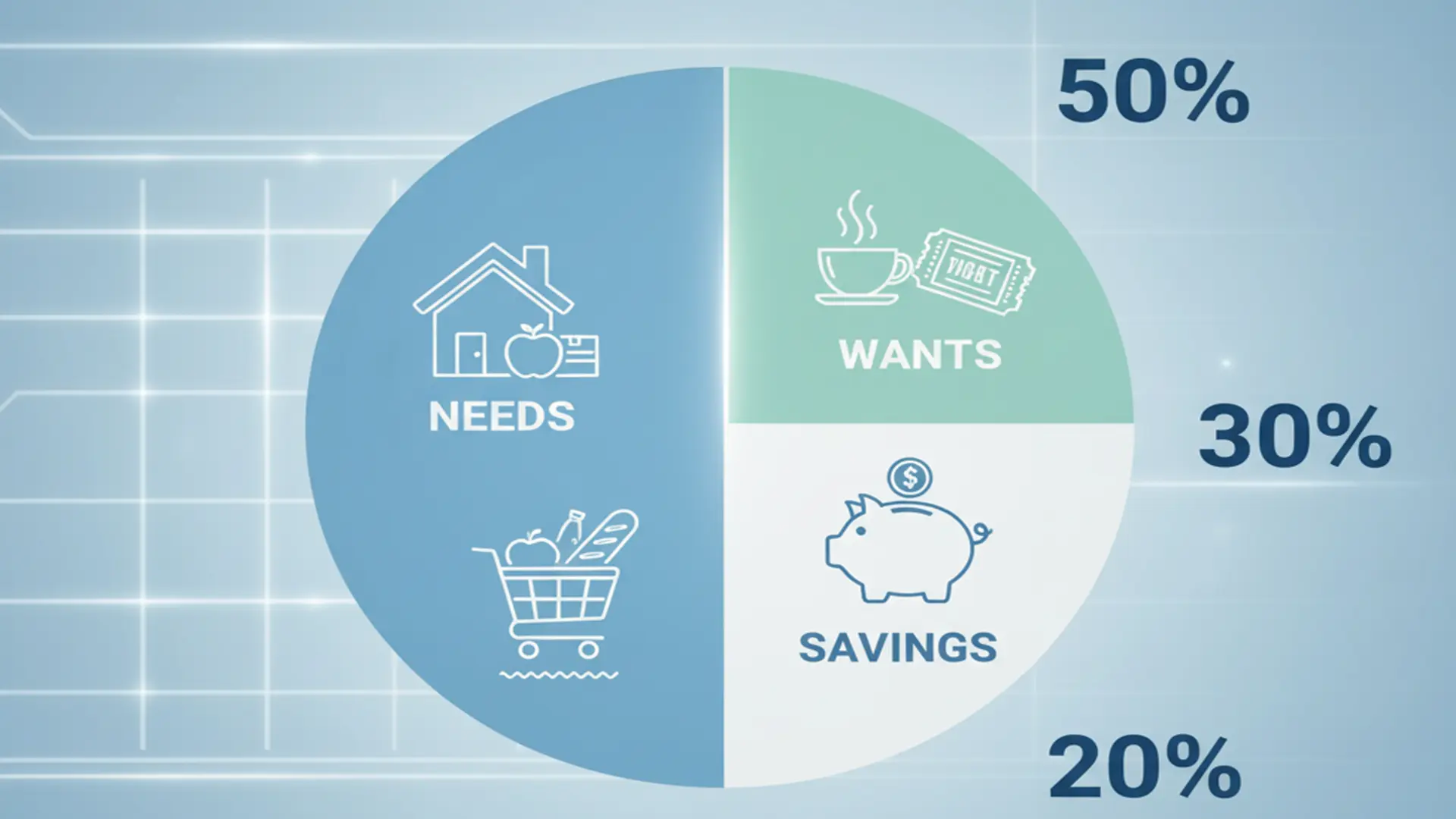

The 50/30/20 rule is a budgeting framework popularized by U.S. Senator Elizabeth Warren. It divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. For example, if you earn ₹25,000 a month after taxes, you’d allocate ₹12,500 to needs, ₹7,500 to wants, and ₹5,000 to savings or debt. This approach is flexible, making it ideal for low-income households.

The rule’s simplicity is its biggest strength. It doesn’t require tracking every small expense, unlike some budgeting methods. Instead, it focuses on broad categories, making it easy to follow. Financial planners in 2025 praise its balance between necessity and enjoyment, ensuring you live well while building a secure future.

Understanding Needs (50%)

Needs are essential expenses required to live and function. These include rent or mortgage, utilities, groceries, transportation, and health insurance. For low-income households, needs often consume a large portion of income. If your rent is ₹8,000, electricity ₹1,500, and groceries ₹4,000, that’s ₹13,500—already over 50% of a ₹25,000 income.

To stay within the 50% limit, prioritize these expenses and look for savings. For instance, switch to energy-efficient bulbs to lower utility bills or shop at local markets for cheaper groceries. If needs exceed 50%, you may need to adjust other categories or explore ways to boost income, like a side hustle.

Defining Wants (30%)

Wants are non-essential expenses that enhance your lifestyle. These include dining out, streaming subscriptions, hobbies, or new clothes. For example, a ₹500 monthly Netflix subscription or a ₹2,000 weekend outing falls under wants. The 30% allocation allows you to enjoy life without derailing your finances.

Low-income households may find 30% for wants challenging. If your income is ₹25,000, that’s ₹7,500 for wants, which might feel generous. To make it work, focus on affordable pleasures, like hosting a potluck instead of eating out. Cutting back on wants can free up funds for savings or debt, especially if needs take up more than 50%.

Savings and Debt Repayment (20%)

The final 20% goes toward savings or debt repayment. This includes building an emergency fund, contributing to retirement, or paying off credit card debt. For a ₹25,000 income, that’s ₹5,000. You might put ₹2,000 toward an emergency fund and ₹3,000 toward a loan. This category is crucial for long-term financial stability.

For low-income earners, saving 20% can seem daunting. Start small—₹500 a month adds up to ₹6,000 a year. If debt is a priority, focus on high-interest loans first, as they cost more over time. A 2025 financial report shows that consistent small savings can grow significantly with compound interest.

How to Apply the 50/30/20 Rule

Start by calculating your net monthly income—your take-home pay after taxes. Review your bank statements to list all expenses, then categorize them into needs, wants, and savings/debt. For example, if you earn ₹30,000, allocate ₹15,000 to needs, ₹9,000 to wants, and ₹6,000 to savings or debt. Adjust spending to fit these limits.

If your needs exceed 50%, reduce wants or find cost-saving measures. For instance, carpool to cut transportation costs or cook at home to lower food expenses. Use a budgeting app like MoneyView, popular in India in 2025, to track your spending. Check your progress weekly to stay on course.

Adjusting for Low-Income Households

The 50/30/20 rule may need tweaks for low-income earners. If essentials like rent and groceries eat up more than 50% of your income, try a 60/20/20 or 70/20/10 split. This prioritizes needs while still allowing some savings. For example, with a ₹20,000 income, a 70/20/10 split means ₹14,000 for needs, ₹4,000 for wants, and ₹2,000 for savings.

Explore government schemes like India’s Pradhan Mantri Awas Yojana for housing assistance to reduce costs. Small changes, like using public transport or buying in bulk, can also help. The key is to stay flexible and adjust the rule to fit your reality without sacrificing savings.

Tips for Sticking to the Rule

Consistency is key to making the 50/30/20 rule work. Set up separate bank accounts for each category to avoid overspending. Automate savings by scheduling monthly transfers to a savings account. Review your budget monthly to account for changes like a rent hike or a festival season.

Stay motivated by setting small goals, like saving ₹5,000 for an emergency fund. Reward yourself within the 30% wants category, such as a low-cost outing. Financial advisors in 2025 emphasize that tracking progress boosts confidence and helps maintain discipline.

Conclusion

The 50/30/20 rule is a simple, effective way to manage your money, even on a low income. By dividing your income into needs, wants, and savings, you gain control over your finances. This method balances necessity with enjoyment while building a secure future. Start small, adjust as needed, and track your progress regularly. With commitment, the 50/30/20 rule can transform your financial life, helping you save, spend wisely, and reduce stress.

FAQ

Q: Can the 50/30/20 rule work for irregular income?

A: Yes, use an average of your last three months’ income. Allocate conservatively to ensure needs are covered.

Q: What if my needs exceed 50% of my income?

A: Try a 60/20/20 or 70/20/10 split, cut non-essential wants, or explore cost-saving options.

Q: How do I track my spending for this rule?

A: Use a budgeting app like MoneyView or a spreadsheet. Check weekly to stay within limits.

Q: Is the 50/30/20 rule better than other budgeting methods?

A: It’s simpler and more flexible, ideal for beginners, but adjust it to fit your unique financial situation.

Q: Can I include emergency savings in the 20% category?

A: Yes, prioritize an emergency fund within the 20% alongside debt repayment or other savings goals.