Managing money can feel overwhelming, especially when bills pile up and savings seem out of reach. A simple monthly budget can be a game-changer, helping you take control of your finances. Whether you’re living paycheck to paycheck or aiming to save for a big goal, a budget provides clarity and direction. This guide will walk you through creating a straightforward monthly budget that works for low-income households. By following these steps, you can make every rupee count and build a stronger financial future.

Why a Monthly Budget Matters

A budget is like a roadmap for your money. It shows where your income goes and helps you prioritize spending. Without a budget, it’s easy to overspend on non-essentials, leaving little for savings or debt repayment. For low-income individuals, a budget is even more critical, as it maximizes limited resources. Studies from 2024 show that households with a budget are 30% more likely to save consistently than those without one.

Budgeting also reduces financial stress. Knowing exactly how much you can spend on groceries or utilities brings peace of mind. It empowers you to make informed decisions, avoid debt traps, and plan for future expenses. A simple budget doesn’t require complex tools—just a clear plan and commitment. Let’s dive into the steps to create one.

Step 1: Calculate Your Total Income

The first step in budgeting is knowing how much money you have. Add up all sources of income you receive each month. This includes your salary, side hustle earnings, freelance payments, or government benefits. For example, if you earn ₹20,000 from a job and ₹5,000 from a side gig, your total monthly income is ₹25,000.

Be sure to use your net income, which is what you take home after taxes and deductions. If your income varies, like in freelance or gig work, calculate an average based on the last three months. For irregular income, it’s wise to use the lowest monthly estimate to avoid overbudgeting. This ensures your budget is realistic and sustainable.

Step 2: List Your Monthly Expenses

Next, identify all your monthly expenses. Start with fixed costs, such as rent, utilities, and loan payments. These are bills that stay the same each month. For instance, if your rent is ₹8,000 and electricity is ₹1,500, note these amounts. Then, account for variable expenses like groceries, transportation, and entertainment, which may fluctuate.

To get accurate numbers, review your bank statements or receipts from the past month. If you’re unsure about variable costs, estimate conservatively. For example, if groceries typically cost ₹4,000 but sometimes hit ₹5,000, use the higher figure. This step helps you understand your spending patterns and spot areas to cut back.

Step 3: Categorize Your Expenses

Organizing expenses into categories makes your budget easier to manage. Common categories include housing, utilities, food, transportation, debt repayment, and savings. You can also add a category for discretionary spending, like eating out or hobbies. The goal is to see where your money goes and ensure it aligns with your priorities.

For low-income households, focus on needs over wants. Housing and food should take priority, while discretionary spending can be minimized. A 2025 financial survey found that 40% of low-income families overspend on non-essentials due to poor categorization. Clear categories help you allocate funds wisely and avoid impulse purchases.

Step 4: Set Spending Limits

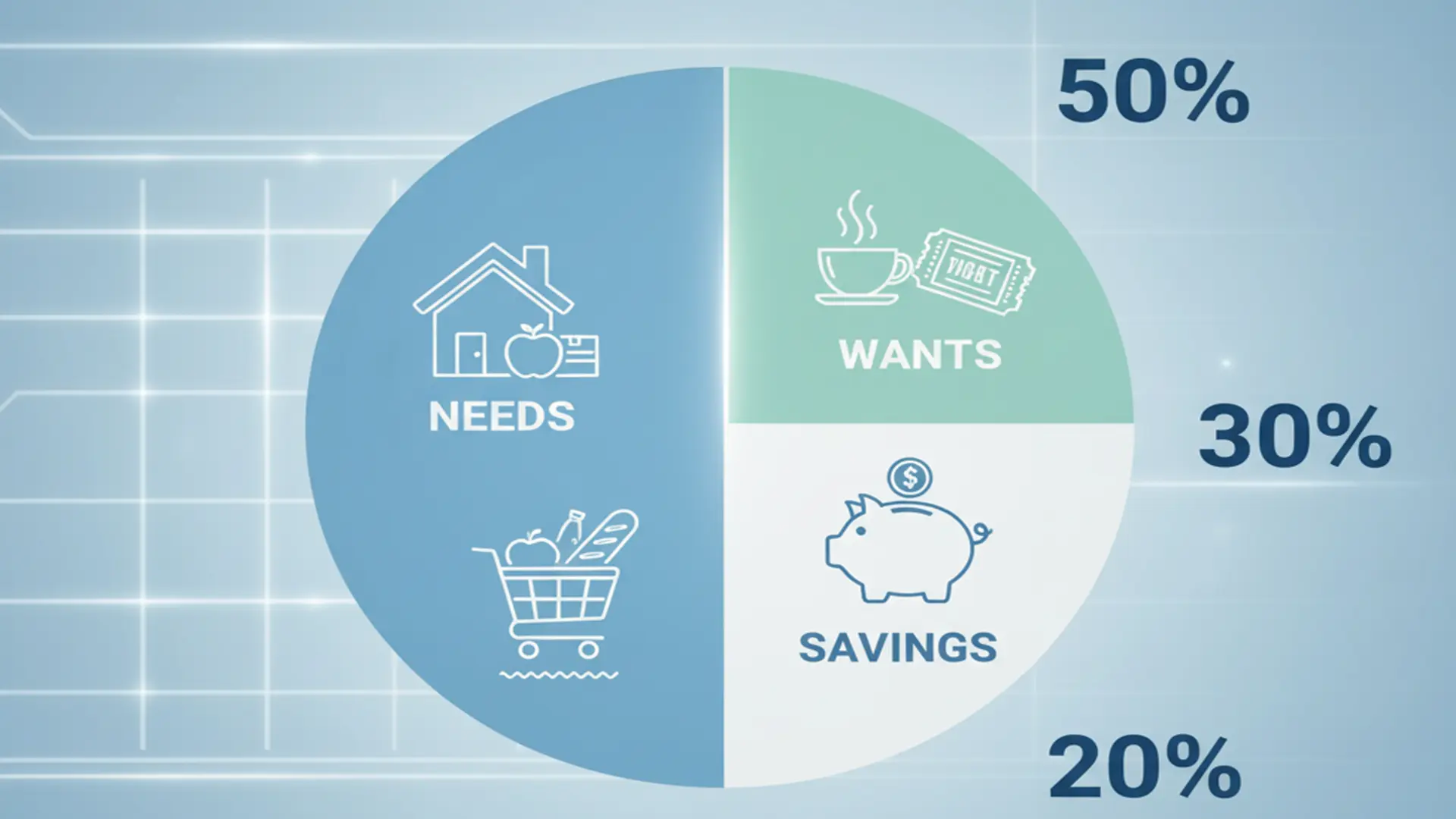

Now, assign a spending limit to each category based on your income and expenses. A popular budgeting method is the 50/30/20 rule. This allocates 50% of income to needs (housing, food), 30% to wants (entertainment, dining out), and 20% to savings or debt repayment. For example, with a ₹25,000 income, you’d aim for ₹12,500 on needs, ₹7,500 on wants, and ₹5,000 for savings or debt.

Adjust these percentages based on your situation. If debt repayment is urgent, you might allocate more to that category. The key is to ensure your total expenses don’t exceed your income. If they do, look for areas to cut, like reducing dining out or switching to a cheaper phone plan.

Step 5: Track and Adjust Your Budget

A budget only works if you stick to it. Track your spending throughout the month using a notebook, spreadsheet, or budgeting app. Popular apps in 2025, like MoneyControl or Walnut, offer free tools to monitor expenses in real-time. Check your spending weekly to ensure you’re within your limits.

Life changes, and so should your budget. If your rent increases or you get a raise, update your budget accordingly. Flexibility is key, especially for low-income households where unexpected expenses can arise. Reviewing your budget monthly helps you stay on track and adapt to new circumstances.

Step 6: Build an Emergency Fund

An emergency fund is a small savings buffer for unexpected costs, like medical bills or car repairs. Even on a tight budget, aim to save a small amount each month—₹500 or ₹1,000 can add up over time. Start by setting aside 1-2% of your income, then gradually increase it.

Keep this fund in a separate savings account to avoid dipping into it for non-emergencies. Financial experts in 2025 recommend having 3-6 months’ worth of expenses saved, but even ₹10,000 can provide a safety net. This fund protects your budget from derailing when life throws surprises.

Conclusion

Creating a simple monthly budget is a powerful step toward financial freedom. By calculating your income, listing expenses, categorizing spending, setting limits, and tracking progress, you can make your money work harder. A budget isn’t about restriction—it’s about empowerment. It helps you prioritize what matters, reduce stress, and build a secure future. Start today, even with a small step, and watch how small changes lead to big results. Commit to reviewing your budget monthly to stay on course.

FAQ

Q: How long does it take to create a monthly budget?

A: It takes about 1-2 hours to create your first budget. Once you’re familiar with the process, updating it monthly takes 15-30 minutes.

Q: Can I budget with an irregular income?

A: Yes, use your lowest monthly income as a base and prioritize essential expenses. Adjust as needed when you earn more.

Q: What if my expenses exceed my income?

A: Look for areas to cut, like discretionary spending, or explore side hustles to boost income. Prioritize needs over wants.

Q: Are budgeting apps safe to use?

A: Reputable apps like MoneyControl or Walnut use encryption to protect your data. Always check reviews and privacy policies before using.

Q: How do I stay motivated to follow a budget?

A: Set small, achievable goals, like saving ₹1,000, and reward yourself with affordable treats, like a coffee, when you hit them.