The money you earn can seem like it disappears from your hands and you’re probably living on a limited income. A budget can be a valuable instrument that provides peace and control to your financial situation. It’s not about limiting your spending, but making informed decisions with each dollar. For households with lower incomes, budgeting can transform your life saving you money the cost of stress, cut down on your expenses, and reach your goals. This article will explain why a budget is crucial as well as how you can improve your financial life.

The Power of a Budget

The budget can be described as a blueprint for how you’ll use and save money each month. It will show where your income is going and helps you decide the things that matter. Without a budget it’s easy to spend too much on the smallest things and leave nothing to save for or for emergencies. A survey on financials in 2025 found 70 percent of those who budget are more confident in their financial situation than those who don’t.

For families with low incomes A budget is a way to maximize limited resources. It makes sure that essentials such as food and rent are covered and also allows to save. Budgeting isn’t only an option for the wealthy, but it’s an instrument for all to create confidence as well as peace at mind.

Reducing Financial Stress

Financial worries could keep you awake all late at night. Uncertain of the best way to pay for bills or deal with the unexpected costs can create anxiety. A budget eases stress by providing an accurate overview of your finances. If you know precisely what you will invest, you can make your decisions confidently.

A 2024 study found that households with a budget have reported 40% less financial stress. In India where rising costs in 2025 are putting pressure on budgets, having a clear picture is essential. A budget allows you to make plans for events as well as medical expenses or school fees, thus avoiding the last-minute faffs.

Achieving Financial Goals

Budgeting can transform goals into a reality. It doesn’t matter if you’re saving to fund a child’s education the purchase of a new smartphone, or a small getaway, budgeting can help to set goals and achieve them. If you allocate even a small amount of money per month to savings, you will create something worthwhile. For instance, a sum of Rs500 a month is equivalent to about an annual amount of Rs6,000, enough to fund an incredibly small emergency savings account.

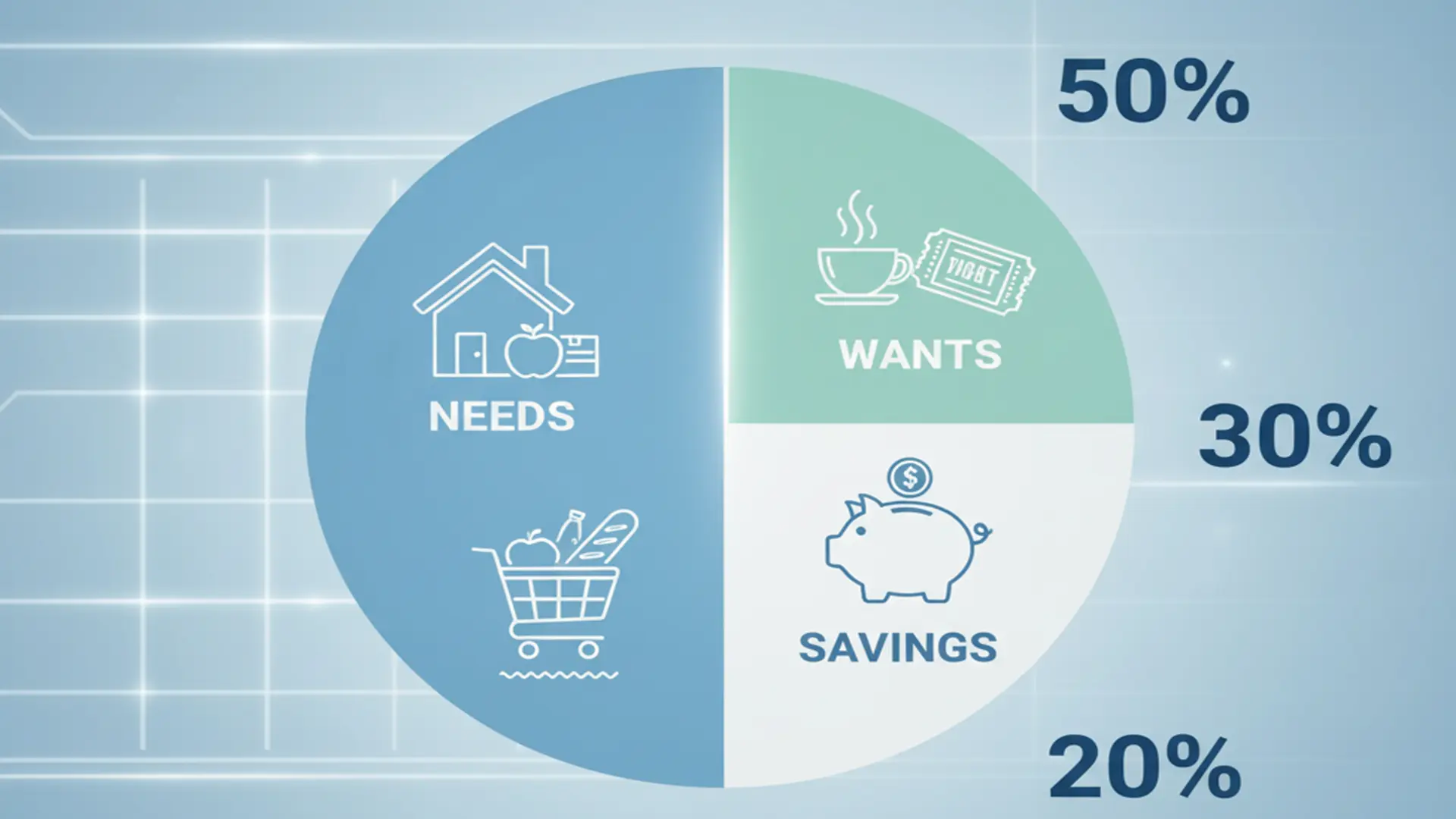

With no financial plan, the goals tend to be beyond reach. For those with low incomes, it is possible to use simple techniques such as the 50/30/20 rule to make sure they balance their desires, needs and savings. This method makes goals that are big appear possible with each step taken at one at a time.

Avoiding Debt Traps

Insufficient spending can result in high-interest credit or credit card debt that is difficult to get rid of. Payday loans, which are common in India and elsewhere, can cost up to 300 percent annual interest, putting families with low incomes trapped in a vicious spiral of financial debt. Budgeting helps to live within your budget which reduces the need to take out loans.

Through tracking your expenditures, you will be able to identify areas that can be cut down, such as eating out or purchasing impulse items. Saving these funds to the necessities as well as an emergency fund helps avoid the need for loans. Budgeting helps build an insurance policy, shielding your financial assets from financial dangers.

Building Long-Term Wealth

Budgeting isn’t only about making it through from month to month. It’s about building wealth. Even with a small income, small savings can increase over time thanks to compound interest. For instance, if you save each month at a 5 percent interest rate on an account for savings can grow to Rs12,600 over the course of a year. In 10 years, that’s greater than Rs1.5 lakh.

In India the country, schemes such as Public Provident Fund (PPF) or recurring deposit accounts offer secure methods to save. Budgets ensure that you will consistently contribute, however small. This discipline is the basis to ensure financial stability.

How to Start Budgeting

Start by calculating your net monthly income, which is your take-home salary after tax. If, for instance, you earn a monthly salary of Rs25,000 this is your base. Make a list of all costs including rent, food and other expenses and then categorize them into wants, needs and savings. Make use of a simple system such as the 50/30/20 rule that is 50% for necessities (Rs12,500) 30 percent for desires (Rs7,500) and 20 percent in savings and credit (Rs5,000).

Keep track of your spending using a notebook or an app like MoneyControl which is widely used in India by 2025. Check your budget every month to adapt for any changes, such as the increase in rent. Start small, and don’t worry about perfection–consistency is key.

Making Budgeting Work for Low-Income Households

Low-income earners face unique challenges, like high essential costs. If the expenses exceed 50 percent of your earnings change to a 70/20/10 or 60/20/20 split. Consider cost-saving alternatives, such as grain rations that are subsidised through India’s card system or less expensive services through government programs. These can be used to free up funds to save.

Side hustles, such as selling homemade snacks or doing freelance work online, can help boost your earnings. Make sure you are putting extra money into the savings account or to debt payment. Budgeting lets you know the areas where minor changes can make an enormous difference even with a small income.

Staying Committed to Your Budget

Budgeting requires discipline, however it’s easier once you’ve mastered the art. Set achievable, small goals like saving up to 11,000 in an emergency savings account. Automate savings transfers into an account that is separate from your bank account to prevent spending. Reward yourself for milestones with affordable rewards like a reward of Rs50.

Check your budget frequently to ensure you are on the right your budget. Changes in life, such as job loss, medical expenses, or holidays–require flexibility. A report on the financial situation for 2025 showed regular reviews of budgets increase savings by 25 percent. Keep your commitment and your budget will soon become a routine.

Conclusion

A budget is much more than just a tool for managing finances. It’s an essential tool for life. It relieves stress, aids you meet your goals, reduces debt and creates wealth, even with the lowest income. When you plan your budget and saving regularly you can gain control and confidence. Start today by making a simple budget and see how it changes your financial situation. Small steps can lead to huge positive results.

FAQ

Q: Why is budgeting important for low-income households?

A: Budgeting maximizes limited income, ensures essentials are covered, and helps save for emergencies or goals.

Q: How long does it take to see results from budgeting?

A: You’ll notice less stress within a month. Savings and debt reduction can take 3–6 months to show significant progress.

Q: Can I budget with an irregular income?

A: Yes, use your lowest monthly income as a base and adjust as needed. Prioritize needs and small savings.

Q: What’s the easiest way to start budgeting?

A: List your income and expenses, use the 50/30/20 rule, and track spending with a notebook or app.

Q: How does budgeting help with debt?

A: It identifies overspending areas, freeing up money to pay off debt faster and avoid new loans.